Epidemics of Liquidity Shortages in Interbank Markets

Financial contagion from liquidity shocks has been recently ascribed as a prominent driver of systemic risk in interbank lending markets.

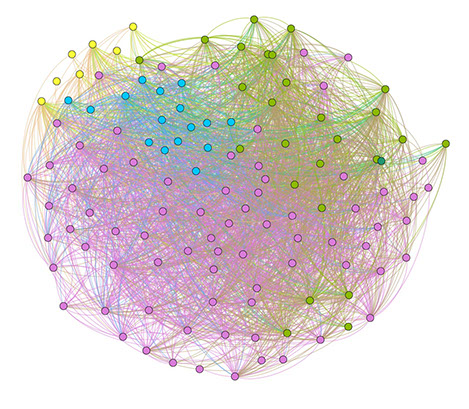

Building on standard compartment models used in epidemics, in this work we develop an EDB (Exposed-Distressed-Bankrupted) model for the dynamics of liquidity shocks reverberation between banks, and validate it on the electronic market for interbank deposits data.

We show that the interbank network was highly susceptible to liquidity contagion at the beginning of the 2007/2008 global financial crisis and that the subsequent micro-prudential and liquidity hoarding policies adopted by banks increased the network resilience to systemic risk—yet with the undesired side effect of drying out liquidity from the market.

We finally show that the individual riskiness of a bank is better captured by its network centrality than by its participation to the market, along with the currently debated concept of “too interconnected to fail”.