Diversification versus specialization in complex ecosystems

Economic Complexity is a novel approach embedding tools of complexity science into economics. Within this framework we analyzed the firm differentiation process.

In fact Countries and firms are fundamental actors sharing complex economic and social ecosystems, but while firms are specialized entities, countries display diversified features which have been demonstrated to be crucial in understanding their competitiveness. This raises a question on the mechanisms driving specialized entities to organize themselves into diversified super-structures which are a quite ubiquitous question in natural and social sciences.

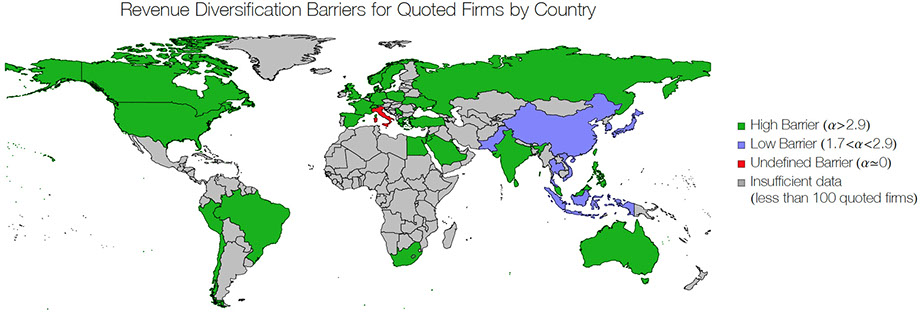

In the particular case of firm diversification we identify in this paper a country-dependent micro signature, the revenue diversification barrier, which we indicate to be the factor governing the diversification dynamics.

In this paper we analyze the Bloomberg data of the distribution of revenues across production sectors of quoted firm aggregated by country. This distribution manifests a peculiar (country dependent) triangular shape, in which a clear lower boundary appears, indicating that firm diversification is positively correlated with revenues: to increment its diversification a firm must increase its incomes by a minimum critical amount which is country-dependent. We design a simple mathematical model to shed new light on these dynamics.

The model suggests that the diversification process develops over time and depends on the competitive environment in which the firms are embedded.The country dependence of the firm diversification barrier shows a non trivial geographic clustering, possibly reflecting different cultural and entrepreneurial patterns. Our findings show that within the framework of economic complexity it is possible to identify the mechanism responsible for micro-macro information exchange.