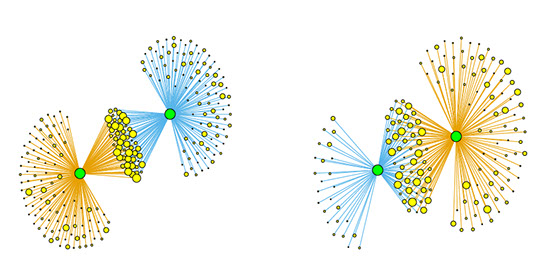

Statistically validated network of portfolio overlaps and systemic risk

Common asset holding by financial institutions (portfolio overlap) is nowadays regarded as an important channel for financial contagion with the potential to trigger fire sales and severe losses at the systemic level.

We propose a method to assess the statistical significance of the overlap between heterogeneously diversified portfolios, which we use to build a validated network of financial institutions where links indicate potential contagion channels. The method is implemented on a historical database of institutional holdings ranging from 1999 to the end of 2013, but can be applied to any bipartite network.

We find that the proportion of validated links (i.e. of significant overlaps) increased steadily before the 2007-2008 financial crisis and reached a maximum when the crisis occurred. We argue that the nature of this measure implies that systemic risk from fire sales liquidation was maximal at that time.

After a sharp drop in 2008, systemic risk resumed its growth in 2009, with a notable acceleration in 2013. We finally show that market trends tend to be amplified in the portfolios identified by the algorithm, such that it is possible to have an informative signal about institutions that are about to suffer (enjoy) the most significant losses (gains).