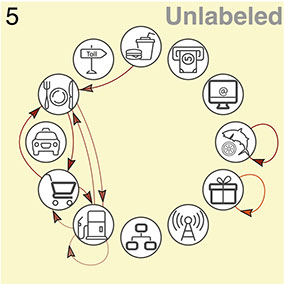

Sequences of purchases in credit card data reveal life styles in urban populations

Credit card transactions combined with mobile phone data can be analyzed to uncover five types of spending habits or life styles at unprecedented scale.

These life styles present consistent relation with age, total expenditure, gender, and the diversity in mobility and social networks of the identified individuals. As motifs in network science represented important insights in networks with power-law degree distributions.

The life styles extracted in power-law labeled data. as the type of users’ expenditure, reveals essential information on human behavior. The aim of this project is twofold: firstly, discovering the existence of ubiquitous trends in spending behavior patterns and how these trends connect with other attributes of our social life.

Secondly, developing a new tool for big data analysis to overcome several limitations of machine learning affinity algorithms. We have developed a novel framework to analyze the records of credit card transactions that enables the identification of the characteristic signatures of humans’ life styles.

Our method, for the first time in the academic literature, couples credit card records with mobile phone records and demographic characteristics of individual users to provide a comprehensive picture of humans’ behavior at unprecedented scale, unveiling relation between human mobility, spending behavior and social activities.

Over a longer timeframe, such analysis could also reveal signals about how people are coping with a wide range of environmental and economic shocks and stressors. Understanding the changes in the patterns of expenditure sequences of vulnerable population groups under external shocks (e.g. natural disasters or economic adversities) and it will be useful to develop early warning and monitoring mechanisms to inform public policies to protect these populations.

Big Data and the Well-being of Women and Girls, Applications on the Social Scientific Frontier (Section III)

Analyzing Economic Activity with Credit Card and Cell Phone Information

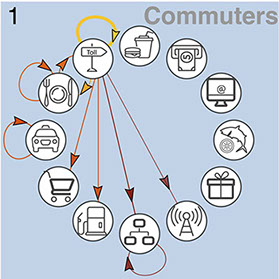

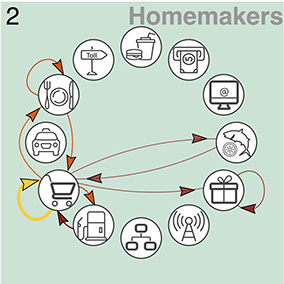

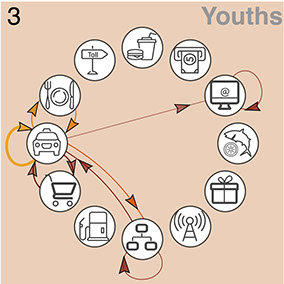

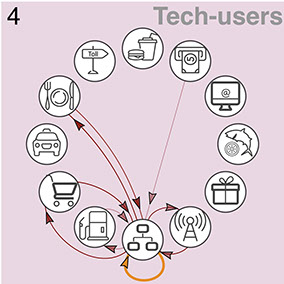

The identification of economic lifestyle clusters is a vital input for policy formulation. Subgroups within a population have distinct social and economic needs.

For example, commuters may be hit hardest by fuel price increases, and the creation of inexpensive and efficient public transport systems may be an important investment in urban areas, especially those where low-income residential areas and job opportunities are not in proximity.

The analysis above shows also that groups like homemakers and youth have distinct patterns of expenditure from other segments of the population. Information of this kind facilitates an analysis of the relative costs and benefits of policies to improve (say) access to affordable food, information services, or transport. There are differences between women in each group and men in the overall sample.