Self-induced consensus of Reddit users to characterise the GameStop short squeeze

The short squeeze of GameStop (GME) shares in mid-January 2021, primarily orchestrated by retail investors of the Reddit r/wallstreetbets community, represents a paramount example of collective coordination action on social media, resulting in large-scale consensus formation and significant market impact.

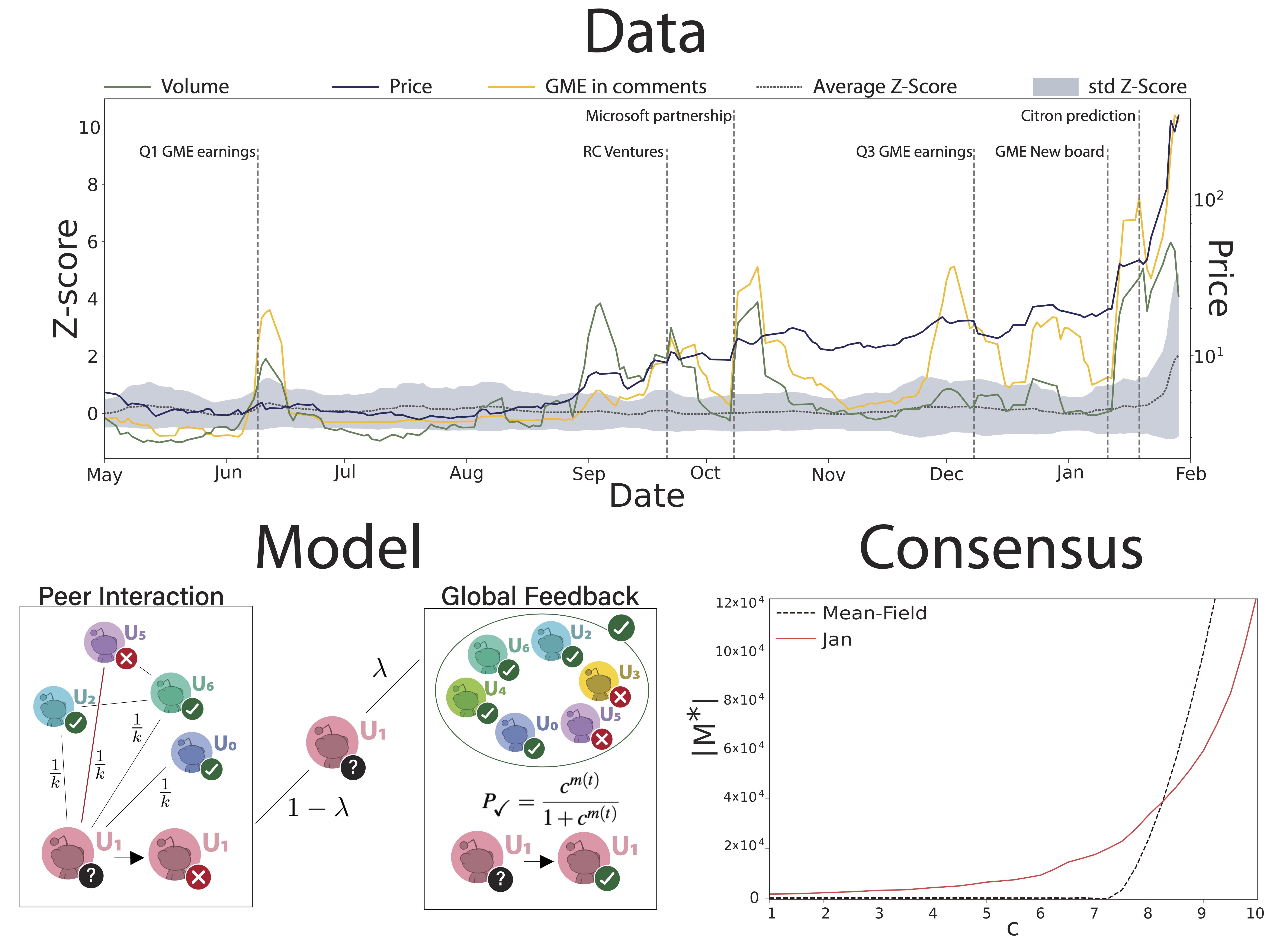

In this work we characterize the structure and time evolution of Reddit conversation data, showing that the occurrence and sentiment of GME-related comments (representing how much users are engaged with GME) increased significantly before the short squeeze actually took place.

We then introduce a model of opinion dynamics where user engagement can trigger a self-reinforcing mechanism leading to the emergence of consensus on the short squeeze operation. We observe a clear phase transition from heterogeneous to homogeneous opinions as engagement grows, with the presence of hubs easing the formation of diffuse consensus.

Our results shed light on the increasingly important phenomenon of self-organized collective actions taking place on social networks.

The rise and fall of WallStreetBets: social roles and opinion leaders across the GameStop saga

Nowadays human interactions largely take place on social networks, with online users’ behavior often falling into a few general typologies or “social roles”. Among these, opinion leaders are of crucial importance as they have the ability to spread an idea or opinion on a large scale across the network, with possible tangible consequences in the real world.

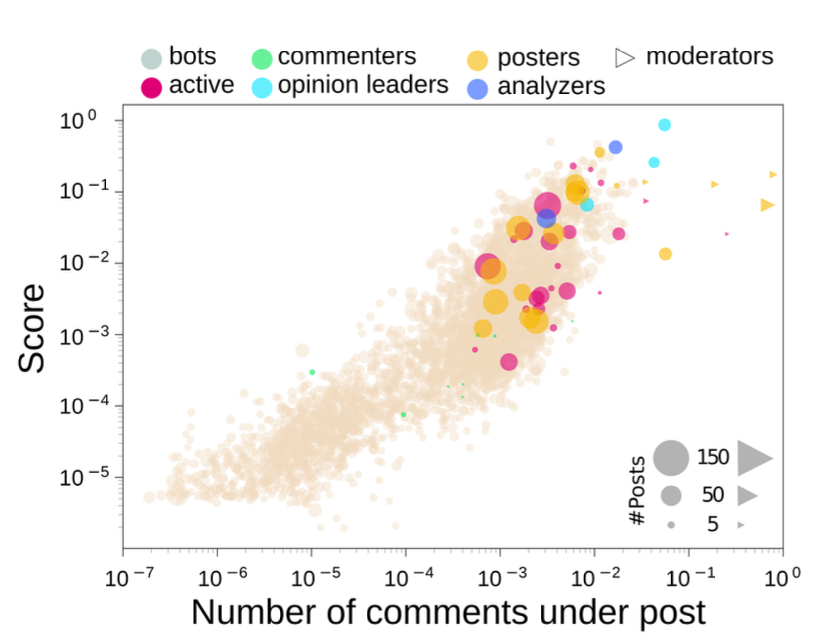

In this work we extract and characterize the different social roles of users within the Reddit WallStreetBets community, around the time of the GameStop short squeeze of January 2021 – when a handful of committed users led the whole community to engage in a large and risky financial operation.

We identify the profiles of both average users and of relevant outliers, including opinion leaders, using an iterative, semi-supervised classification algorithm, which allows us to discern the characteristics needed to play a particular social role. The key features of opinion leaders are large risky investments and constant updates on a single stock, which allowed them to attract a large following and, in the case of GameStop, ignite the interest of the community.

Finally, we observe a substantial change in the behavior and attitude of users after the short squeeze event: no new opinion leaders are found and the community becomes less focused on investments. Overall, this work sheds light on the users’ roles and dynamics that led to the GameStop short squeeze, while also suggesting why WallStreetBets no longer wielded such large influence on financial markets, in the aftermath of this event.